Defintions

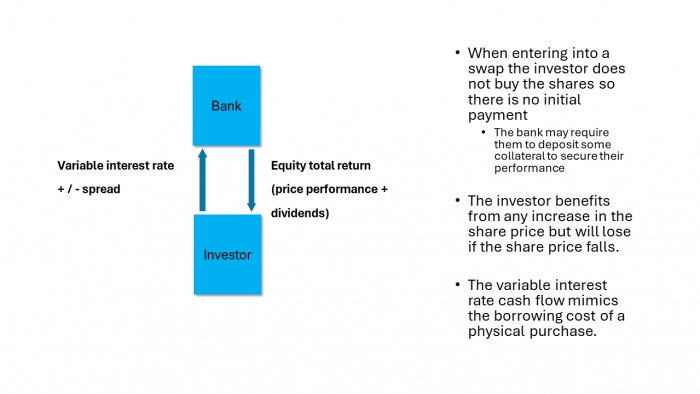

A total rate of return swap is a fixed for floating swap in which cash flows are exchanged but the floating rate on one side is based on the total rate of rate of return that would have been earned by the underlying asset or index including elements such as dividends and compounded yields. The other leg would normally reference some form of floating rate.

Equity swap example

Suppose a US or European hedge fund wished to take exposure to China Telecom. It may be difficult for this type of entity to access this specific market and so they could enter into an total return equity swap where they receive the increase in the price of the share against paying a floating rate plus a funding spread. If the share price rises, they will make money from the swap and if it is total return in nature, they will be paid any dividend. If the share price falls, they will pay any depreciation across to their counterparty.

The offsetting leg can be thought of as a kind of funding cost. If they had bought the share outright, they would have to pay a borrowing cost. If the spread to the chosen floating benchmark on the swap is less than their normal cost of borrowing, then the deal will be advantageous.

The deal can be structured in any currency (e.g. USD) not just that of the share’s own country (CNY).

Commodity swap example

Another application for the total return swap is when the deal references an asset class that is difficult to trade physically. Commodities are a classic example of this. An investor could receive the rate of return of a commodity index such as the S&P GSCI in return for an offsetting cash flow such as a Treasury bond yield. These structures are a little more complex and are worthy of a separate post. In the meantime, for those that cannot wait, I do document this in my commodity derivatives book (chapter 14). Cue shameless plug: https://www.amazon.co.uk/Commodity-Derivatives-Markets-Applications-Finance/dp/1119349109/ref=tmm_hrd_swatch_0?_encoding=UTF8&qid=1661160178&sr=8-2